Media agencies in Australia have notched up another year of market growth, delivering the sixth consecutive year of higher advertising expenditure, jumping by 1.9% in 2018 to a record $7.02 billion.

The numbers are from Standard Media Index (SMI), which is the global industry standard for actual ad spend data. It sources its data directly from the booking systems of the industry’s largest media agencies - the ones that take part.

Growth was concentrated in the first half of the year up 5.5% to $3.5bn, while bookings in the six months that followed were slowed by a drop in media spend from the banking, insurance and food and produce categories.

The pull back on advertising from banks is to be expected following the royal commission.

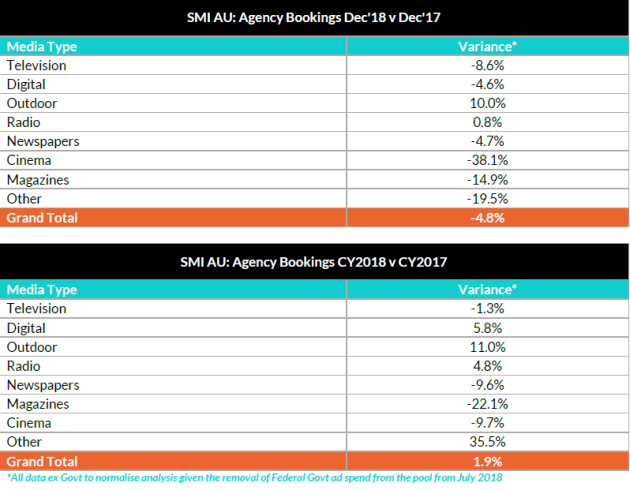

The year ended with a softer month in December with demand slipping by 4.8%, although there was continued improvement in metropolitan press with total spend back just 1.1%.

Total bookings for the fourth quarter of 2018 were back 3.3% mostly due to large declines in ad spend from the domestic banks (-23.4%), food/produce/dairy (-15.6%) and restaurants (-13.4%) categories.

Out of home advertising overtook digital media as the fast-growing media category, growing its share of agency spend to 13.7%. Despite this, it was still a strong year for digital media which reached $2bn in agency ad spend for the first time.

Out of home was also the bigger winner in agency bookings for 2018, up 11% year-on-year, while magazine booking took a massive blow dropping by 22.1%, with closures of major titles likely to be the biggest contributor.

Radio media reporting its sixth consecutive year of record ad spend.

Television bookings took a slight dip in 2018, down by 1.3%, while total TV bookings for December were back 8.6%, however, the Seven, Prime and Foxtel businesses reported positive results off the back of the new cricket broadcasts.

"We’ve seen agencies spending more on metropolitan TV for the third year in a row while also branching into new media services such as podcasting and digital outdoor as clients continue to test new services to gain the best value from their advertising investment," SMI AU/NZ managing director Jane Ratcliffe says.

Record levels of annual ad spend for the categories of retail, automotive brand, gambling, domestic banks, other financial services, travel and pharmaceuticals were also noted.

Ractliffe says the year was also notable for a significant change in growth drivers within the digital media, with search and social media bookings delivering the highest growth.

"The search media returned to very strong growth in 2018 after a more subdued 2017 while social media maintained strong double-digit growth across both years,’’ she says.

"But the biggest change was the large slowdown in growth in programmatic bookings, as in 2017 that market had grown by $174.3 million but in 2018 the increase is a far reduced $19.4 million and as a result, Programmatic’s share of total digital bookings fell across all time periods.’’

Below are the table supplied by SMI detailing further figures:

In 2016 one of the big six global media agencies, IPG Mediabrands, withdrew globally from taking part in SMI.

It was understood that a change in the fees that SMI pays agencies for their data could be behind the decision.

More broadly, as owned, earned and shared media channels continue to become a greater proportion of the media ecosystem, with IPG's UM pivoting its entire business model to address owned and earned media first. It's been suggested by some sources that exiting SMI reflects that shift in IPG's strategy.

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.