News Corporation chief executive Robert Thomson has denied there is an M&A frenzy in Australia confirming the business' focus on bringing together Foxtel and Fox Sports.

In an investor call regarding News Corp's full-year results, talk of any mergers or acquisitions, to perhaps combat the looming mega merger of Nine and Fairfax, was slim. Instead, Thomson said Foxtel would work much more closely with News Australia’s mastheads to cross-promote programming.

“The new Foxtel will work much more closely with the mastheads, which will become an important marketing platform,” he said.

The comments on cross-channel tactics follows news of Nine and Fairfax's plans to merge their businesses to create an “all-platform, media business”.

In the investor call Thomson talked up the positive impact the Foxtel and Fox Sports merger and new Foxtel leadership with Patrick Delany at the helm.

“[At Foxtel] there’s a new team, a new mood and new momentum. That will be crucial for the success in driving subscriptions for the health of a business,” Thomson said.

“There’s no doubt Foxtel has the best portfolio of programs and sports rights, which has been enhanced by cricket rights.

"Australian audiences are willing to pay for premium programming, [more so] than we previously assumed.”

Thomson said a new sports OTT streaming product, which is due to roll later this year, would help drive subscriptions and a Foxtel IPO is still on the cards.

See: Foxtel to unveil sports and entertainment streaming services

Thomson welcomed the addition of cricket rights in the summer, providing Foxtel with an annual sporting calendar that would help retain subscribers in the summer when there is traditionally seasonal household churn.

News Corp has posted fiscal year earnings of more than $1 billion for the first time driven by strong gains in its digital real estate business.

Growth includes additional revenue from the consolidation of Foxtel-Fox Sports as part of subscription TV segment.

In December, Australia's competition watchdog the ACCC gave the proposed merger between Foxtel and Fox Sports the green light. The move saw News Corp's (which owns Fox Sports) equity in Foxtel rise to 65% and Telstra's share reduced to 35%.

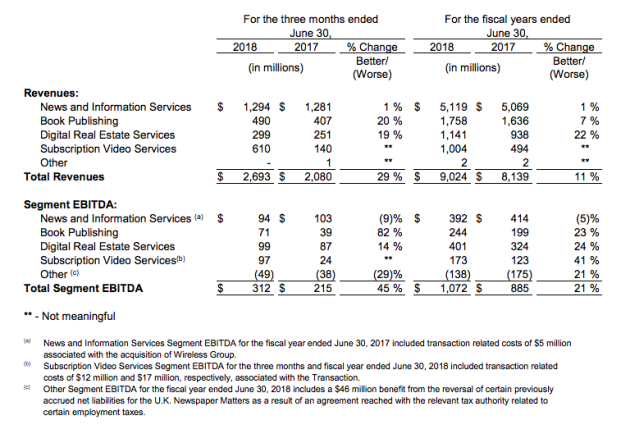

Revenue for the global media group increased 11% to $9.02 billion, while EBITDA grew 21% to $1.07 billion. However, the company reported a fiscal year loss of $1 billion due to a $974 million non-cash write down of its investment in Foxtel.

On an adjusted basis that measures organic growth, News Corp grew revenues by 2% to $8.22 billion and EBITDA by 6% to $956 billion.

The number of subscribers to Foxtel grew 2% to 2.8 million in the year to 30 June 2018.

Elsewhere, News Corp’s news and information segment, which includes its mastheads, grew quarterly revenues by 1% to $1.29 billion in the fourth quarter and by 1% to $5.12 billion in the fiscal year.

In the quarter, advertising revenue declined $12 million, or 2%, globally, but this was more than made up by 5% growth in subscriptions to $26 million.

The decline was driven by weakness in the print advertising market and the decision to cease The Wall Street Journal’s international print editions in the second quarter of fiscal 2018. The decline was partially offset by the growth in digital advertising revenues at News Corp Australia and News UK, increase in advertising revenues at Wireless Group and the positive impact from foreign currency fluctuations.

In Australia the ad revenue decline was more pronounced at 6%.

Advertising revenue now makes up less than a third, with subscriptions and non-advertising revenue contributing 70%.

Digital revenues represent 30% total revenue in the quarter, which is up from 26% a year ago.

Thomson said that News Australia would continue to undergo tight cost control.

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.