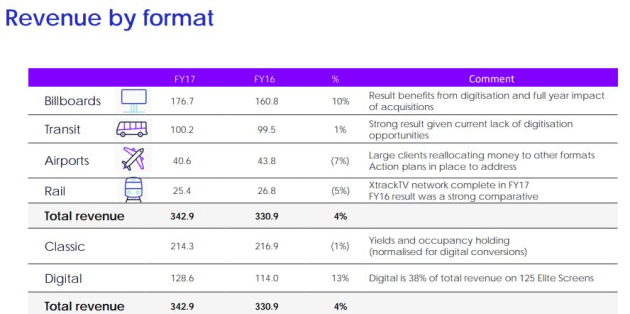

APN Outdoor has reported modest revenue growth of 4% to $342.9 million in a year distracted by a failed merger with Ooh!Media and a changing of the guard at the helm.

To put that into perspective, market leader Ooh!Media reported 13% revenue growth in calendar year 2017 and the outdoor sector grew 6%.

QMS recently reported a revenue lift of 25%, albeit from a much smaller base, in the six months to 31 December.

APN Outdoor, which also unveiled its new corporate branding by Hulbosch, increased its EBITDA by 4% to $90.3 million. This is well below the 22.5% EBITDA reported by Ooh!Media.

Most of APN Outdoor's growth has been due to the digitisation of roadside billboards and the impact of acquisitions.

Transit remained flat, while there were revenue declines in airport (down 7%) and rail (down 5%).

APN Outdoor boss James Warburton recently told stakeholders that the failed merger and leadership changeover had “stalled” progress at the outdoor company.

“2017 was a very difficult year for the company. The fact is if the Ooh!Media merger had gone through the company wouldn’t exist,” Warburton said last Thursday evening.

“When you go the other way and the merger ultimately fails and you have the transition of the long-term CEO of a company, it has the effect of stalling where you are both internally and more broadly in the marketplace.”

See full story here: 'We need to sort out measurement and become more creative' - APN Outdoor CEO

The reported fiscal cost of the failed merger was $3.4 million, while former boss Richard Herring's retirement cost the business $1.7 million.

The inertia caused by both is difficult to fully quantify in monetary terms, but it's fair to say that APN Outdoor is behind market rivals on a few fronts, particularly when it comes to digital conversion of its classic billboards.

Digital revenue accounts for 38% of APN Outdoor's overall pie, which is below the market (47%) and the market leader Ooh!Media (60%).

It will spend between $25 million to $30 million this year to rollout up to 25 new digital (Elite) screens.

Another reason for APN Outdoor's under par results is that it has focused on selling assets rather than helping advertisers connect to audiences, an approach that Ooh!Media first adopted four years ago.

Warburton said APN Outdoor's approach to market would shift to becoming audience led by leveraging data and technology partnerships with Pureprofile, Rubicon Project and Data Republic.

The new chief executive also stressed the importance of retaining business as well as winning new business.

The business will also announce a new CFO and chief innovation and strategy officer soon. Innovation and strategy will be important focal points for APN Outdoor in the year ahead.

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.