Advertising agencies are the great survivors but the way through the economic fallout of COVID-19 will be tough, according to industry analysts.

A proprietary survey of advertising professionals by investment bank Credit Suisse shows the industry is challenged, with a “below-average likelihood” of a successful transition through the slump.

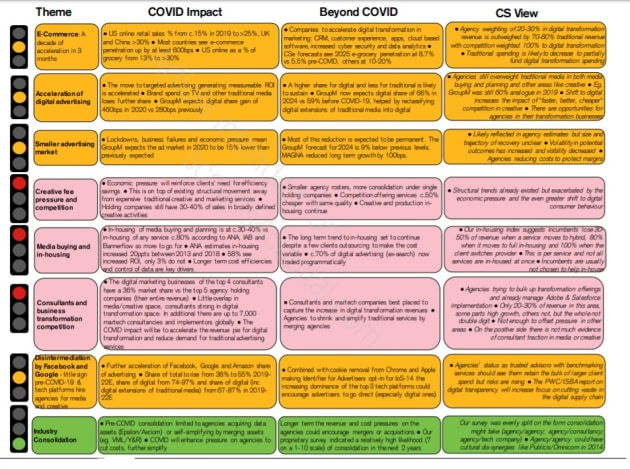

“Over the past decade they have grappled with the move to digital media, and now they are attempting another shift to ‘digital transformation’, combining media, creative and marketing technology,” Credit Suisse says in a 100-page report to clients.

“This is being accelerated by the COVID-19 crisis and a sea-change in consumer and business behaviour, especially in e-commerce.”

The Credit Suisse study, a global focus looking at mainly Europe and North America, is part of a series called Beyond the Pandemic.

It shows ad agencies in an increasingly crowded space with strong competition, not only from consultancies but also many specialist independent agencies, tech firms and marketing technology providers.

“This will make for a tough transition,” say the analysts.

Longer term, group and media buying margins are likely to fall, with agencies expected to grow just 1% post COVID-19, based on the survey.

Australian industry analyst Steve Allen, the managing director of Fusion Strategy, says Credit Suisse is making a bold call.

“Sure, we are presently living in a vastly changed consumer market but this is a condition forced on us,” he told AdNews.

“Plus this study does not take into account the quite different and much better statistics and handling of COVID-19 in Australia and New Zealand, especially when contrasted with many countries in Europe and the US.

“When COVID-19 conditions ameliorate, and/or a vaccine is found and administered, everything will not stay in its altered state. The majority of consumer behaviour will reset.

“We in Australia are somewhat shielded, as our economy is small (by comparison) and the cost and necessary expertise is more difficult to afford and bring in house for marketers.”

The Credit Suisse study also sees a high risk from Facebook and Google.

On the positive side, the study rates agencies well for creativity and sees a high chance of consolidation.

“At least 70% of agencies’ revenue is still in traditional services, making the timing of acceleration in digital transformation especially tricky,” say the analysts.

COVID -19 has accelerated a shift to ecommerce by business with a subsequent move to digital advertising to capture this.

This means more advertisers need to find consumers online and accelerates the shift of ad spending to Amazon and other tech platforms.

“The pandemic is giving CEOs and other senior management the impetus to increase the pace of digital transformation,” say the analysts at Credit Suisse.

“All of the main consultancies and many others have seized on the crisis as a marketing opportunity for their transformation services in cloud, customer experience, data collection and analytics, and IT security.”

An EY survey of more than 200 senior managers from across 162 financial services firms found that 87% believe working from home due to the pandemic will result in firms’ tech transformation developing far faster than they had previously expected.

Organic growth

Average organic growth of the main agency holding companies has fallen since 2016, when it was around 4%, to almost flat in 2019.

This is for several reasons including clients seeking efficiencies and reducing the number of agencies with whom they work.

Creative fees have also come under pressure from new competition and in-housing of creative and production work, as well as producing fewer adverts.

And media growth is slowing due to a tougher focus on transparency and in-housing of some functions.

Meanwhile, average margins have been stable/rising due to cost control, and back-office and rental efficiencies.

The Credit Suisse’s survey, with 50 responses, was among senior professionals from the marketing ecosystem, a majority of whom are agency professionals but also with contributions from adtech, tech platforms, agency auditors, advertisers and media owners.

“On the longer-term questions around the agency business model, likelihood of successful transformation and margins, the responses were cautious, including from the agency professionals,” write the analysts.

The respondents saw the likely long-term organic growth rate for agencies as about 1% and saw a high likelihood of future disintermediation by Facebook and Google.

They saw the threat from consultants as moderate and saw a below-average likelihood of a successful shift from traditional to business transformation revenues.

The moderate threat from consultants refers to their impact on traditional agency services rather than digital transformation which is the consultancy heartland.

They also believe there’s a reasonably strong likelihood of industry consolidation over the next two years and were fairly equally split over whether this would be a combination of agency with agency, agency with consultant or agency with tech company.

Many (44%) cited Martin Sorrell’s S4 Capital as the agency that is most likely to experience long-term financial success. This was double the next option, Omnicom, on 22% and the third option, WPP, on 19%

COVID-19

The impact of COVID-19 on the advertising market and on agencies is shaping up to be severe, says Credit Suisse.

The economic backdrop seems to be similar in most regions, with severe compression of economic growth and consumption followed by a sharp rebound but to a point that is a lower level than 2019.

Publicis CEO Arthur Sadoun: “We are now all facing a crisis that will be unparalleled in terms of magnitude, complexity, and probably length. There is no doubt that we are going through an unprecedented health crisis that will lead us to the greatest recession in living memory”.

The findings from the Credit Suisse study:

Forecasts by company, according to Credit Suisse:

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.