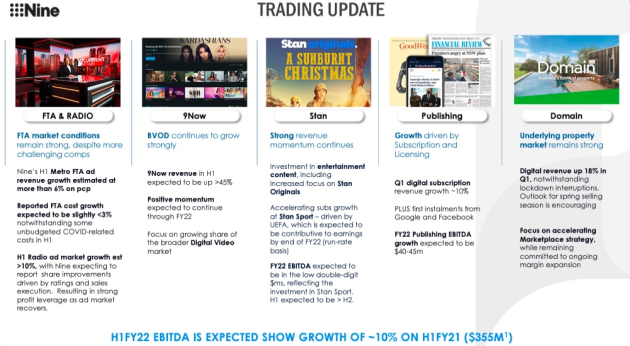

Nine says metro free-to-air advertising revenue for the half year to December is expected to be up by more than 6% on the same half last year.

This is around 6% ahead of the pre-COVID half year.

Nine will more than offset one-off, and unbudgeted, COVID-related production costs, of around $5 million across the year. Reported cost growth for for the full year is now expected to be slightly below the 3% previously cited.

9Now revenue for the first half is expected to be up by more than 45%.

Nine’s first half EBITDA, before specific Items, is currently expected to be up by around 10% on the first half last year, after accounting for targeted investments in Stan Sport, 9Now and Publishing.

CEO Mike Sneesby says early signs for the second half remain positive. However, Nine believes it is too early to give guidance for the full year result.

Sneesby told the company's AGM: "The trends that we cited at the full year result in August have continued.

"The underlying advertising market remains robust across all key advertising segments, and Nine’s leading content is underpinning strong share across all of our distribution platforms."

He says Nine’s radio ratings and audiences have been strong, with Nine’s talk network achieving its best results in recent surveys.

At this stage, the radio ad market is expected to be up by more than 10% for the half.

"Advertising momentum has clearly improved post the lockdowns in Sydney and Melbourne," says Sneesby.

"Through Nine Radio’s improved ratings and refocused direct sales execution, we are expecting to record some clear share gains, adding additional leverage to profitability as the advertising market recovers."

Subscriber growth at Stan benefitted from the recent lockdowns, and is expected to consolidate over the December quarter.

Stan Sport subscriber growth has accelerated, driven by the recently commenced UEFA season.

Previous EBITDA guidance for Stan of low double-digit millions of dollars in FY22 remains, with phasing of sports costs expected to result in a stronger first half than second half.

In Nine Publishing, growth is being primarily driven by subscription and licensing, with september quarter digital subscription revenues up by around 10%, and the inclusion of revenue from Google and Facebook.

Reflecting this growing subscription base, coupled with stronger-than-expected advertising results (both digital and print), Nine now expects growth in Publishing EBITDA in FY22 of $40 million to $45 million, ahead of previous guidance of $30 million to $40 million.

"Through 2021, we have focused on supporting our people through the challenges we have all faced – through flexible working arrangements and on-site COVID testing as well as a range of initiatives focused on the health and wellbeing of our people," he says.

"The result of this focus and investment is reflected in Nine’s recently completed Engagement survey, with overall employee engagement increased across all key business segments year-on-year."

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.